Dare to prioritize: A 4-step approach to developing a focused SDG strategy

Key takeaways:

- Organization should dare to prioritize and develop a focused strategy on key SDGs that are closest to its organization’s strategy and core competencies

- Prioritizing on specific SDGs does not mean neglecting other SDGs, it simply means an organization can communicate a focused approach

- Prioritizing requires an understanding of an organization’s mandate, how a portfolio contributes to the SDG agenda, and the local context in which the institution fits in

- Defining priority SDGs means an organization can prioritize impact measurement for these targets (in the long term)

Financial institutions (FIs) have adopted the SDGs as lingua franca to communicate on impact ever since they were first introduced in 2015. Last year, we conducted a study on international best practices looking to identify first steps FIs can take to integrate SDGs in a meaningful way.

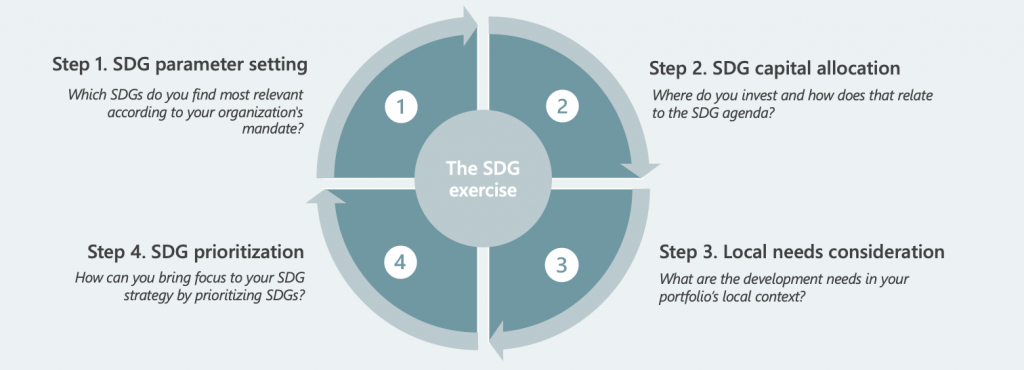

Our conclusion? Dare to prioritize on the SDGs. However, this is sometimes met with some resistance, as organizations fear this might be perceived as neglecting other SDGs. It is clear to us that prioritizing on SDGs does not mean neglecting other SDGs – it simply means that organization can communicate a focused approach. Furthermore, prioritizing on SDGs sets the right foundation for developing a robust impact measurement strategy. For this reason, we developed ‘The SDG exercise’ – 4-step approach to help FIs prioritize on strategic SDGs.

‘The SDG exercise’

FIs can effectively set up a strategy around the SDGs only when they prioritize on the SDGs that are most relevant to their organization. A prioritization exercise requires a wider understanding of many different parts: how a portfolio contributes to the SDG agenda, the local context in which the institution fits in, and the long-term strategy or mandate. Our 4-step approach, to be implemented in a workshop format, helps organizations prioritize on SDGs (see below).

Step 1. SDG parameter setting

In the first step, the objective is to develop an understanding of the organization’s mandate in relation to the SDG agenda. In this step, an organization can reflect on the SDGs that are most aligned with the organization’s mandate, for example, based on specific products/credit lines. If an organization has a credit line with a focus on gender, it can select SDG 5 – Gender Equality as strategic to the organization.

Step 2. SDG capital allocation

The objective of the second step of our approach is have the organization reflect on how its portfolio contributes to the SDG agenda. This requires a mapping of the negative and positive interactions between sector and sub-sectors in portfolio and the different SDG targets. In this step of the process, organizations can start to reflect on any divergences between their SDG parameters and their SDG capital allocation and derive insights.

Step 3. Local needs consideration

The objective of the third step is for the organization to gain insight into the development needs of beneficiaries in a local context and reflect on how that can be incorporated into their SDG strategy. The SDGs are a global agenda but considering the local context helps to prioritize on the impact that local beneficiaries can benefit the most from.

Step 4SDG prioritization

The ‘SDG exercise’ culminates in Step 4: SDG prioritization. The objective is for the organization to select a maximum of 5 ‘priority SDGs’. This is done considering the different insights from the previous steps (i.e., the SDG is relation to the institution’s mandate, its portfolio contribution, and the local needs in the context in which it operates).

A tested approach

Associação Brasileira de Desenvolvimento (ABDE) is Brazil’s national development finance association, bringing together 31 public and private Development Finance Institutions (DFIs). We worked with ABDE to develop and implement the SDG exercise amongst its members, in collaboration with a local consultancy (SITAWI).

“Development Financial Institutions are crucial to meet the Sustainable Development Agenda and this project carried out by Steward Redqueen and developed by ABDE in partnership with the German Agency for International Cooperation (GIZ) and the Development Bank of Latin America (CAF) is definitely an important step in the right direction to support Brazilian DFIs to incorporate the 2030 Agenda. Thus, we expect them to become more efficient in allocating capital targeting the SDGs, increasing DFIs contribution to a sustainable transition in Brazil.” Jeanette Lontra, President of ABDE.

Impact measurement comes later

Impact measurement is the necessary next step for managing and steering on impact – in other words, to use impact data to inform internal decision-making. This requires a data-driven approach to SDG integration, looking at the impact of a portfolio in terms of jobs supported, GHG emissions avoided, etc., and linking those metrics to the SDG agenda. To have these insights, organizations need impact measurement frameworks, with tangible and feasible targets that they can monitor and report on. However, implementing such impact management frameworks is the result of many years of maturing practices and we see prioritization as a necessary first step.

If you are interested to know more about the work we do on the SDGs, reach out to Beatriz Ramos at beatriz.ramos@stewardredqueen.com