Essentials of SFDR for investment fund managers

In this article, our Manager Impact Policy & Regulation Danijela Piljic provides you with the essential things you need to know about the Sustainable Finance Disclosure Regulation (SFDR). What is it and why is it relevant? What’s the difference between articles 6, 8 and 9? And how can we help you comply?

What is SFDR?

The SFDR is developed by the European Commission and defines mandatory sustainability disclosure requirements for all financial market participants. These include asset managers, investment firms, banks, pension funds and life insurers in the European Union. The SFDR aims to increase transparency in the market for sustainable investment products, help end investors make informed choices by enabling comparability of sustainable information and prevent greenwashing.

What are the SFDR requirements?

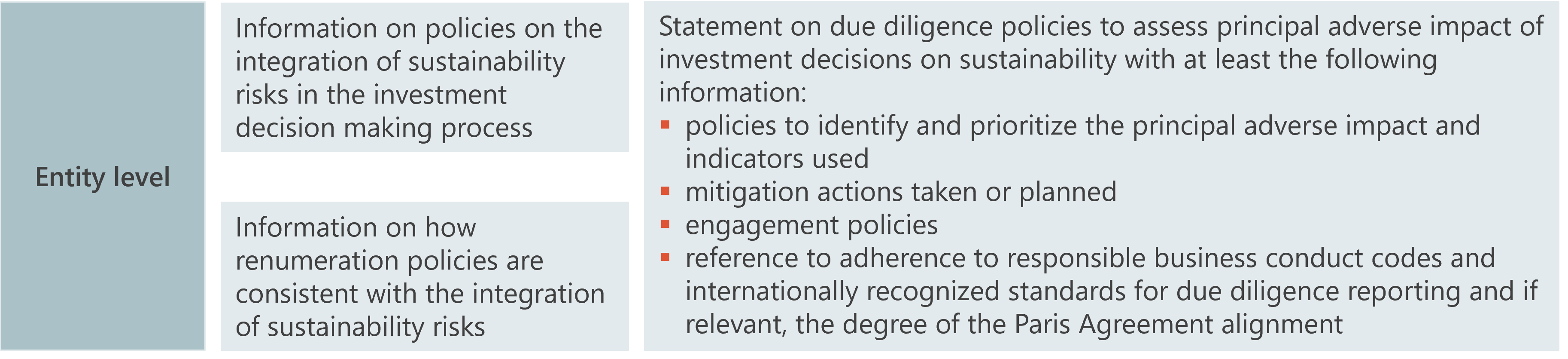

The SFDR requires financial market participants to disclose sustainable information on entity and financial product level.

Figure 1 summarizes the key requirements on entity level to be disclosed on the financial market participant’s website. The statement at entity level is mandatory for financial market participants with more than 500 employees. For others, a “comply or explain” requirement applies. The SFDR Delegated Act provides detailed information and templates.

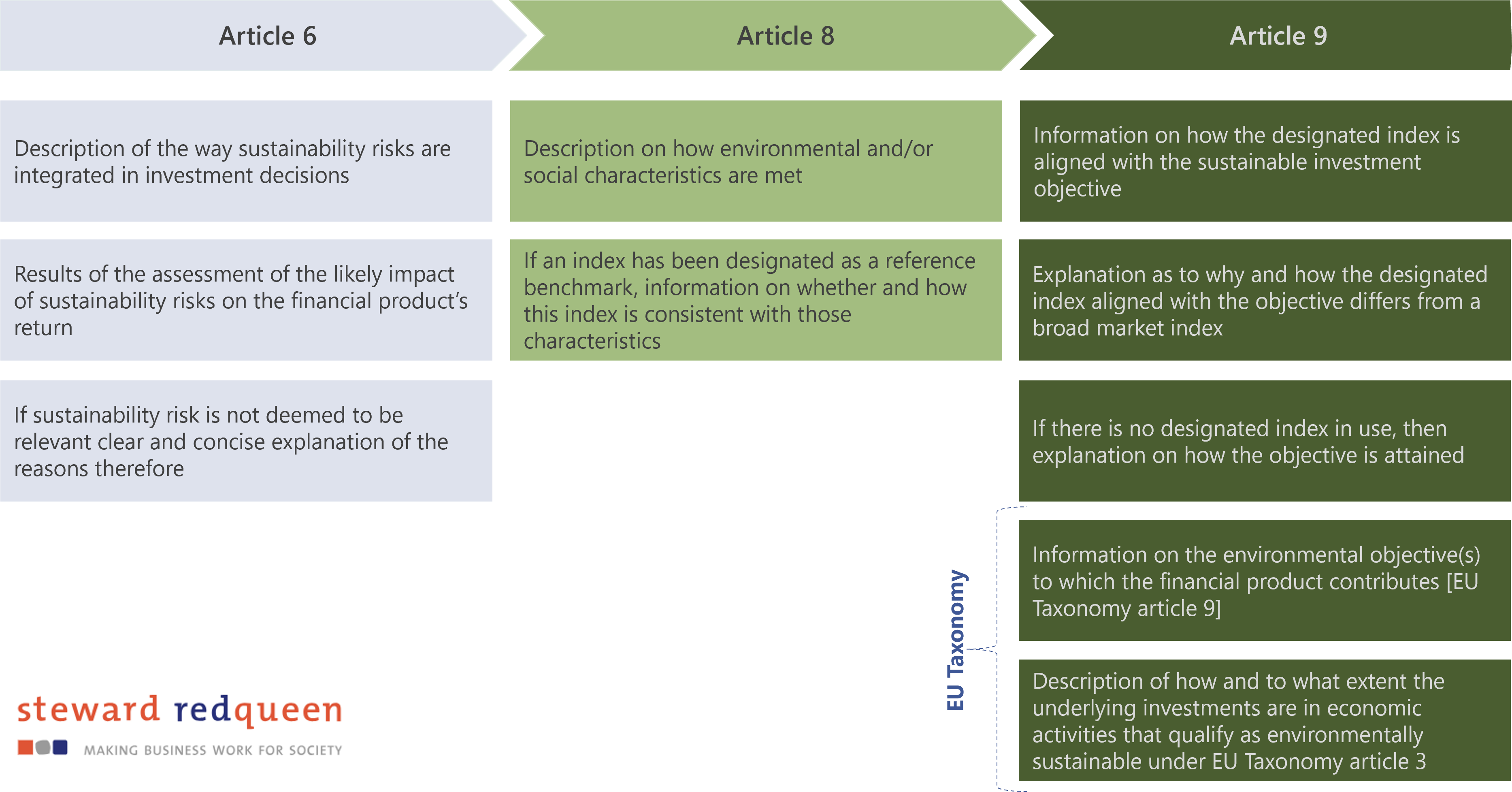

On financial product level, the SFDR provides financial market participants with a classification framework to classify their financial products as an article 6, 8 or 9 – depending on the characteristics and level of sustainability:

- Article 6 refers to all financial products regardless of their sustainability nature. The information to be disclosed pursuant to article 6 needs to be accompanied by additional requirements depending on the financial product classification.

- Article 8 applies to financial products which promote environmental and/or social characteristics, provided that investments are made in companies which follow good governance practices.

- Article 9 concerns financial products that have sustainable investment objective. These financial products need to make a positive impact on society or the environment through sustainable investment and therefore put impact

Therefore, article 9 financial products are referred to as dark green, while article 8 financial products are seen as light green. The figure below summarises the key pre-contractual disclosure requirements at financial product level. Finally, for each financial product financial market participants need to disclose whether, and, if so, how a financial product considers principal adverse impacts on sustainability.

Why comply with SFDR?

Although the SFDR is a disclosure regulation, compliance with its requirements should not be a checking the box exercise for several reasons. First, the SFDR forces you to think strategically about setting up a robust and transparent ESG/impact frameworks that in turn can reduce sustainability risks and offer more insight into the desired impact. Second, reporting on your financial products in a transparent and comparable way can improve your access to capital market financing. Finally, from a reputational angle, compliance with the SFDR requirements serves as a positive signal to current and prospective clients and investors.

How does SFDR link to the EU Taxonomy and CSRD?

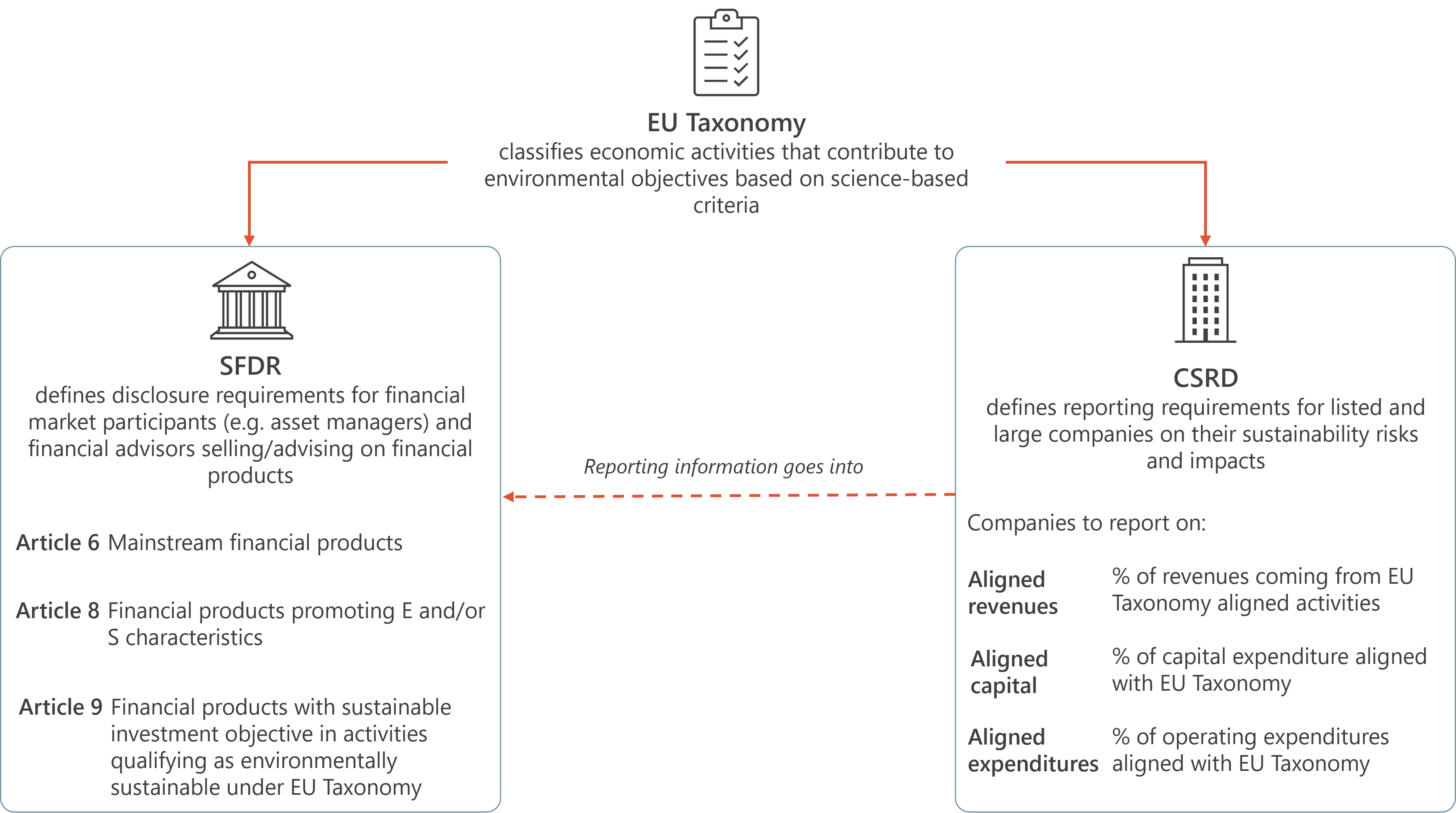

You probably also have heard of the Taxonomy and the Corporate Sustainability Reporting Directive (CSRD). So how do these fit together, and where may they be relevant to you? The figure below visualises how they are connected.

The EU Taxonomy is a classification system that helps companies and financial market participants identify environmentally sustainable economic activities to make sustainable investment decisions. Environmentally sustainable economic activities are described as those which “make a substantial contribution to at least one of the six EU’s climate and environmental objectives, while at the same time not significantly harming any of these objectives and meeting minimum safeguards.”

The EU Taxonomy is integrated in the SFDR by requiring financial market participants to disclose information on which of the six objectives their financial products with sustainable investment objective contribute to and how and to what extent the underlying investments concern environmentally sustainable economic activities.

The CSRD aims to make sustainability reporting by companies more consistent, so that financial market participants can use comparable and reliable sustainability information for disclosure in the SFDR. Companies that fall under the scope of the CSRD have to report in their annual reports to what extent their activities are covered by the EU Taxonomy (Taxonomy eligibility) and comply with the criteria to qualify as environmentally sustainable economic activities (Taxonomy alignment).

How can Steward Redqueen help?

Whether you’re directly or indirectly affected by the SFDR, Steward Redqueen can help you to comply with the requirements. What do we offer?

- SFDR 101: we can provide insight by organizing a focused workshop for staff on what it takes to comply with the SFDR, and any customized training where necessary.

- Gap analysis: we can conduct a regulatory gap analysis of your SFDR alignment, provide advice on the SFDR classification and help develop an impact investment strategy.

- ESG/impact frameworks: we support you in the development of practical ESG- and impact frameworks that meet regulatory requirements.

For more information on SFDR and what this means to you, reach out to danijela.piljic@stewardredqueen.com