Financing the Just Transition: A How-to Guide

Our pathway to net zero and climate resilience requires a profound transformation of our economy. This transformation implies a transition process, which is already impacting a range of sectors, regions, and communities. The most obvious example is the Oil & Gas sector: as we become less reliable on fossil fuels, the sector will have to adapt and reinvent itself for the future.

The international community is increasingly recognizing that a transition process should be equitable and fair for all, with the term ‘Just Transition’ been coined to reflect that vision. A Just Transition means greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities, and leaving no one behind. Importantly, the Just Transition describes not only where we are going, but also how we should get there.

Financial institutions (FIs) are expected to play a pivotal role in stimulating a Just Transition, ensuring that affected businesses, employees, consumers, and communities are considered and supported. However, guidance on how FIs should contribute to a Just Transition is only now emerging. So, what should FIs do to adequately embed Just Transition considerations in operations? And how can FIs monitor and report on their commitments and performance towards a Just Transition?

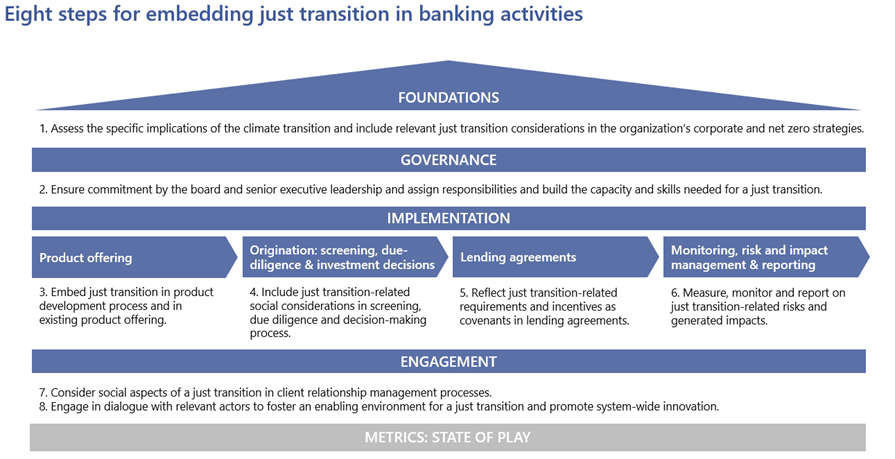

We developed a Just Transition Tool for banking and investing activities in partnership with the International Labour Organisation (ILO) and the Grantham Institute of the London School of Economics. The Tool provides eight practical steps for FIs to embed the just transition. While the Tool provides tailored recommendations for Banks and Investors separately, this short guide provides a more general overview of the suggested actions. For more detailed background on definitions and approaches to embedding the just transition, please access the Tool here.

Step 1. Include Just Transition considerations in the corporate and net zero strategies

A first step in showing commitment is to include relevant Just Transition considerations in the corporate and net zero strategies of the organisation. In order to do include considerations in a meaningful way, banks and investors first need to assess social and employment implications of the climate transition and consider their materiality in relation to their portfolio, operating environment, risks and opportunities.

Step 2. Ensure commitment, assign responsibilities, and build capacity and skills

Commitment starts from the top, so to effectively embed the Just Transition in the organisation, senior management should show its commitment in internal and external communication. FIs should also ensure that employees have the necessary skills and knowledge, for example by embedding the concept of Just Transition in training and other forms of capacity building.

Step 3. Embed the Just Transition in existing and new products

There are many opportunities related to the Just Transition. The GFANZ estimates that only up to 2025 around USD 2600 billion of investments are needed to support decarbonisation of the economy (link). FIs can identify needs and develop new products by reviewing existing client groups and mapping the transition dynamics they are exposed to. Subsequent examples of products include transition finance, energy efficiency loans, climate risk insurance, or green bonds.

Step 4. Include Just Transition considerations in pre-investment activities

FIs can adopt a Just Transition lens in screening and due diligence by complementing E&S, climate and values-based assessments and questionnaires with material sector- and place-specific social criteria related to a Just Transition. This should then be reflected in internal risk scoring systems and transaction approval prices.

Step 5. Reflect Just Transition requirements and incentives in financial agreements

To incentivise the Just Transition, FIs can consider tailoring standard clauses in financial agreements, such as Use of Proceeds, to divert capital towards Just Transition aligned projects. In addition, verifiable and measurable Just Transition aligned metrics can be included in KPI-linked instruments and capital raising operations. By doing so, an FI can keep track of progress against targets.

Step 6. Measure, monitor and report on Just Transition risks and generated impacts

Reporting on Just Transition related elements can be integrated as part of the social dimension in standard climate-related reporting like the Task Force on Climate-related Financial Disclosures (TCFD). By collecting and aggregating client- or investee-level data, FIs can monitor the organisation’s overall exposure to risks and performance against impact targets.

Step 7. Include the Just Transition in client relationship management processes

FIs can play a pivotal role in advancing the Just Transition by using their leverage over clients and investments and influencing decisions through engagement. Potential engagement areas include i) development of Transition plans; ii) adherence to reporting; and iii) importance of transparent, inclusive, and direct stakeholder engagement.

Step 8. Engage in stakeholder dialogue to promote system-wide innovation

Finally, FIs are encouraged to engage in dialogue with local stakeholders, such as communities, employers, business organisations, trade unions and civil societies, to uncover emerging needs of the low-carbon transition. This feedback can then in turn inform the organisation’s strategy and operations, and close the loop started with step 1.