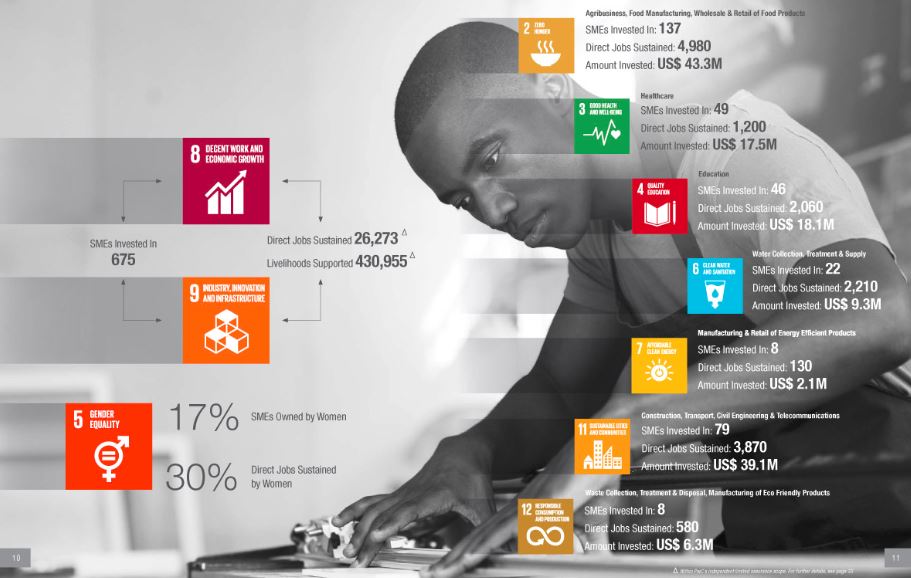

Development finance

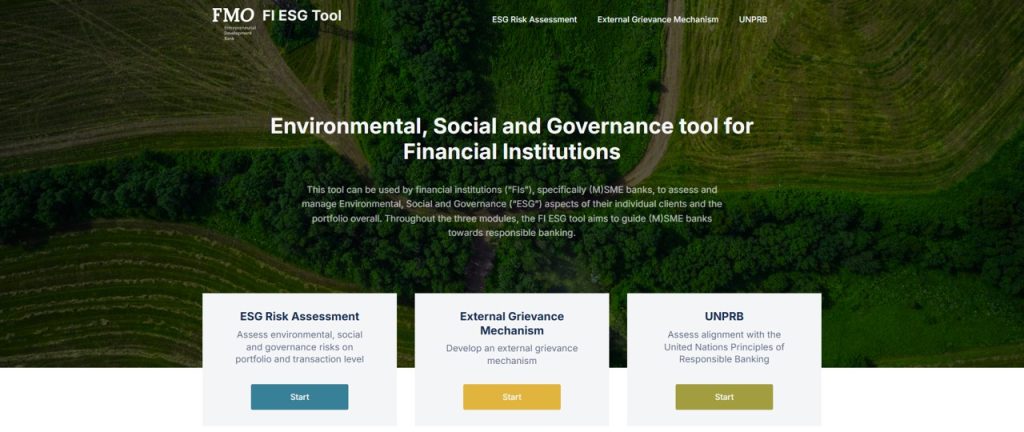

Steward Redqueen has been working with development finance institutions and multilateral development banks for over 20 years. We have supported organisations on ESG and impact management, strategy and policy development and performance evaluations.

Why

The critical role of development finance institutions

Development finance plays a critical role in addressing global challenges—from climate change to inequality—yet it often struggles to allocate capital efficiently in the places and sectors that need it most. Steward Redqueen works at the heart of this dilemma: where capital is scarce, risk is high, and market incentives are weak. We focus on enabling development finance institutions (DFIs), multilateral development banks (MDBs), and impact investors to deploy capital in ways that are both impactful and commercially viable. The challenge is not just to fund projects, but to shape markets, unlock private investment, and ensure outcomes are inclusive and sustainable.

How

Combining strategic, practical and technical expertise

Steward Redqueen brings a rare combination of strategic advisory, on-the-ground understanding, and technical expertise in impact and finance. With deep experience across emerging and frontier markets, we help clients navigate the real-world complexity of development finance, from structuring blended finance vehicles to designing catalytic strategies that mobilise private capital. Our approach is collaborative, analytical, and rooted in sustainability. We combine high-level policy insight with operational know, how, and we use data and models not to overcomplicate, but to inform smart, practical decisions. Above all, we work with clients to translate ambition into action, driving both systemic change and measurable results.

What

The value we bring to the development finance space

We provide clients with clarity and confidence in navigating the fast-evolving development finance landscape. Our services span capital mobilisation strategies, impact measurement, ESG integration, and institutional effectiveness. Whether advising a DFI on its approach to fragile states, designing private capital mobilisation frameworks, or assessing the impact of climate funds, we bring independent, evidence-based perspectives tailored to each context. We help our clients build strategies that align capital with purpose, strengthen accountability, and enhance their catalytic role in the market. In doing so, we contribute to a development finance system that is more responsive, effective, and equipped to meet global challenges.